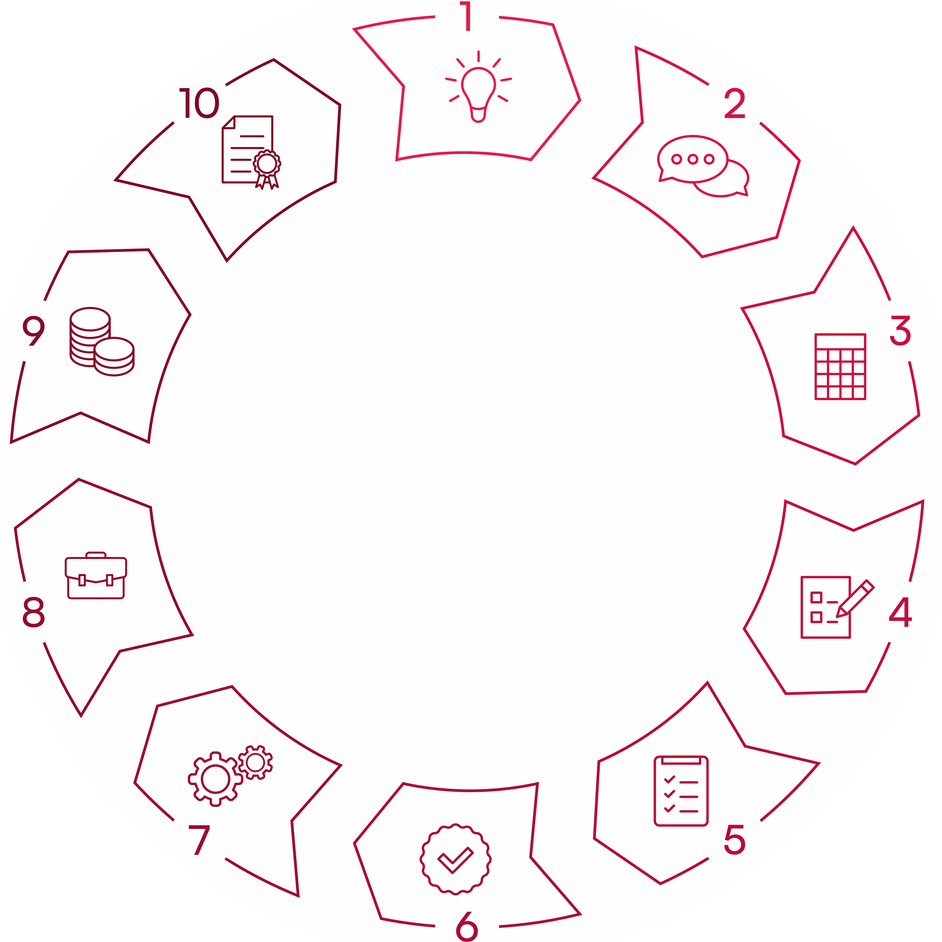

Our services

We are a quality subsidy partner for projects that focus primarily on research and development, innovation, Industry 4.0, sustainable development and environmental activities. We also support companies that want to engage in circular economy and implement principles of circular economy. We have been on the market since 2009 and rely on a personal approach to our clients.