Investment incentives

Are you planning significant investments in manufacturing technology, real estate, technology centres or shared service centres? Would you like to set up a research and development centre? Are you planning to create new jobs? Take the opportunity to support your investment with an incentive.

We will help you take into account the specifics of your project and recommend the investment incentive ideal for your business. We will work with you to prepare all the project documentation and arrange communication with the relevant authorities on your behalf. The evaluation system is continuous, so you can apply for an investment incentive at any time.

Supported activities

- Manufacturing industry: introduction, increase in production or extension of the production range, change in the overall production process (CZ-NACE section C)

- Technology centres: setting up, increasing the capacity of or expanding a research and development centre

- Strategic service centres: start-up, increase capacity or expand output with new services in software development centres, data centres focusing on data storage, sorting and management, high-tech repair centres, shared service centres

Rate and amount of support

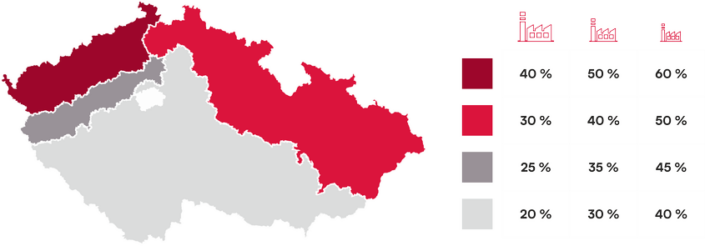

The amount of financial support is calculated as a relevant % of eligible expenditure depending on the size of the enterprise and the region:

- small enterprises 40 % – 60 % of eligible expenditure

- medium-sized enterprises 30 % – 50 % of eligible expenditure

- large enterprises 20 % – 40 % of eligible expenditure

The following table gives a better idea of the aid rate:

Applicant

An entrepreneurial legal or natural person who has at least 2 completed accounting or tax periods in its business with the intention of making an investment in technology centres, strategic service centres and manufacturing industries.

What is the investment incentive for?

- a corporate income tax relief for 10 years

- transfer of land at reduced price

- material support for the creation of new jobs

- material support for the training of new employees

- material support for the acquisition of assets

- exemption from property tax

Programme conditions

- Not having started work on the project before the submission of the plan

- Environmental friendliness

- Preservation of assets and jobs for the entire duration of the incentives, but at least 5 years

- Implementation of the investment project on the territory of the Czech Republic, excluding Prague

- Meeting conditions within 3 years from granting the investment incentives

If you would like more information about investment incentives, please do not hesitate to contact us. The initial consultation is free of charge.